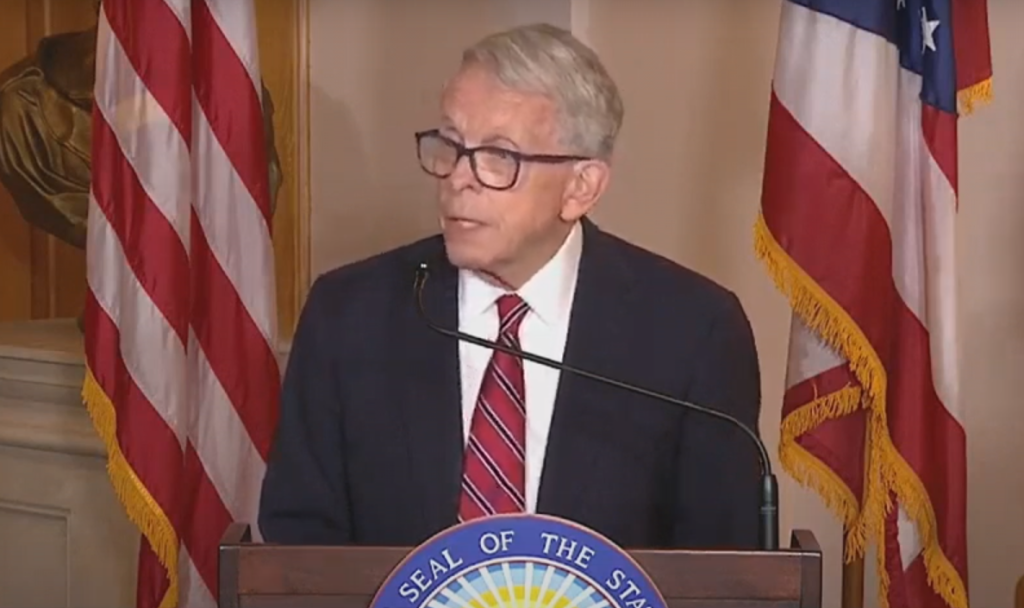

Ohio Gov. Mike DeWine has signed off on a $60 billion two-year state budget that includes a significant investment in a new domed stadium for the Cleveland Browns, a new flat income tax structure, and multiple controversial policy provisions—some of which were vetoed.

The budget, approved late Monday night, includes $600 million in public funding for the Browns’ proposed new stadium in Brook Park. In a statement, team owners Jimmy and Dee Haslam praised the state’s support, calling the enclosed stadium a “transformative project” that will serve as a year-round destination and anchor one of the largest economic developments in Northeast Ohio’s history. The new venue, named Huntington Bank Field, promises to combine cutting-edge design with fan-centric features and host major events beyond football.

The new funding also coincides with a change to Ohio’s so-called “Modell Law,” which previously aimed to prevent sports franchises from relocating from publicly funded facilities without giving local governments the opportunity to buy the team or the facility. Under the revised law, this provision would only apply if a team attempted to leave the state entirely, reducing Cleveland’s leverage as it negotiates to keep the Browns on the lakefront.

Flat Tax and Revenue Impacts

A new 2.75% flat income tax rate will replace the state’s current tiered tax system. This change will eliminate the higher 3.5% rate previously paid by Ohioans earning more than $100,000 per year. The tax cut is projected to reduce general fund revenues by over $1.1 billion—a shortfall covered in part by reducing funding for social programs and limiting certain tax exemptions.

When asked why he approved the measure despite its impact on services for lower-income residents, DeWine replied bluntly: “I can count,” referencing the Republican majority in the General Assembly and the likelihood of a veto override.

Medicaid and Social Services

Parts of the budget include cuts to Medicaid that could affect coverage for up to 800,000 Ohioans, though DeWine used his line-item veto authority to block some of the most severe provisions.

He also vetoed several controversial measures, including:

- Youth Homelessness Funding Restrictions: A proposal to bar funding for shelters that affirm gender identity was struck down. DeWine said that shelters must be able to provide support to vulnerable youth without fear of losing state aid.

- Education Savings Accounts for Non-Chartered Religious Schools: DeWine vetoed this item, citing concerns over accountability and referencing the Bishop Sycamore scandal as an example of what could go wrong without sufficient oversight.

- SNAP Restrictions on Sugary Drinks: While supportive of restricting sugary drinks from SNAP purchases, DeWine partially vetoed a provision, noting that overly specific definitions could delay implementation. A working group will be formed to explore a more practical approach.

- Political Labels on School Board Elections: DeWine rejected a proposal to list political party affiliations on school board ballots, arguing that non-partisan elections better serve education and communities.

- Caps on School District Budget Reserves: A proposed cap on school districts’ cash reserves was also vetoed. DeWine warned that it could undermine local fiscal planning and increase the risk of failed levy renewals.

- Restrictions on Public Libraries: A measure requiring certain books to be restricted from youth access in public libraries was also nixed. DeWine said such rules could interfere with library operations and community standards.

Unclaimed Funds and Property Changes

Another significant change in the budget is a revision to Ohio’s unclaimed funds policy. The state will now assume legal ownership of unclaimed assets after ten years—a shift from the previous policy of holding funds in perpetuity. Lawmakers plan to tap into $1.7 billion of the $4.8 billion pool of unclaimed funds immediately to support the state budget.

What’s Next

While many provisions have already sparked debate, others, such as the Browns’ stadium funding and flat tax implementation, are likely to have long-term impacts on both Ohio’s economy and its residents. The budget’s passage marks the beginning of another chapter in state governance—with the effects of these sweeping changes still to be seen.